Thanks! We’ll be in touch with you soon.

Thanks! We’ll be in touch with you soon.

AI Growth Agents for Digital Account Origination

One platform. All accounts. Anytime, anywhere.

From consumers to businesses, drive deposits and loans with a unified entryway for account origination.

TRUSTED BY LEADING FINANCIAL INSTITUTIONS INCLUDING

Accelerate Member and Customer Growth and Engagement

- Transform Onboarding Efficiency

Cotribute’s streamlined onboarding process speeds up customer acquisition with 5x faster rates and account openings completed in under 2 minutes.

- Boost Engagement Through Automation

With automated cross-selling capabilities, Cotribute empowers financial institutions to increase deposits, expand wallet share, and attract more customers.

- Highly Configurable Experiences

Support over 45 financial products with intuitive, API-enabled workflows that adapt to your customers’ needs—anywhere, anytime, and on any device.

Drive Operational Excellence

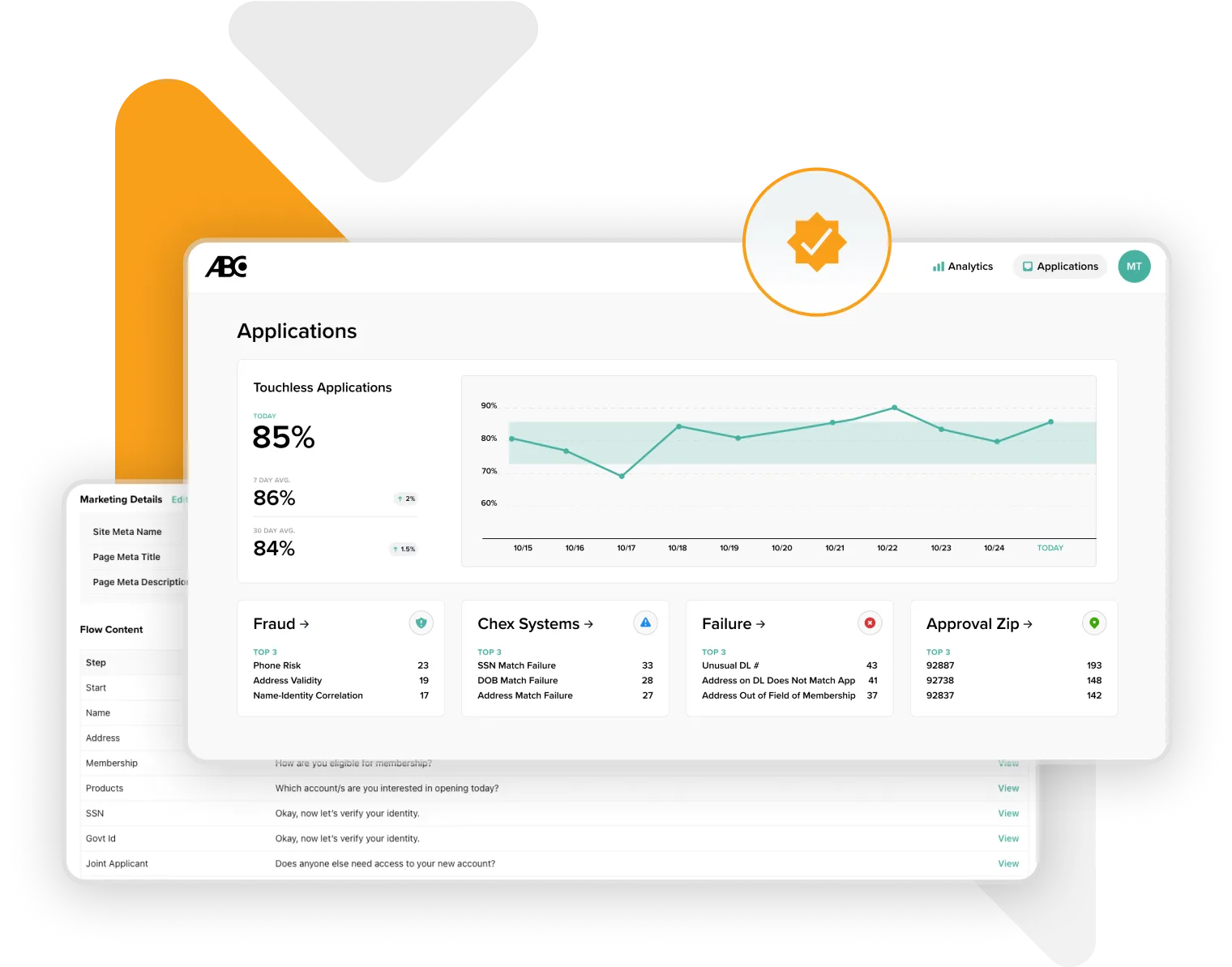

- End-to-End Automation

Eliminate manual bottlenecks by automating 85% of decision-making processes, from fraud detection to core system updates.

- Seamless System Integration

Cotribute integrates effortlessly with core banking systems, loan origination software, and digital platforms, ensuring smooth adoption and operational continuity.

- Empower Your Team

Free staff from repetitive tasks so they can focus on delivering high-value customer experiences.

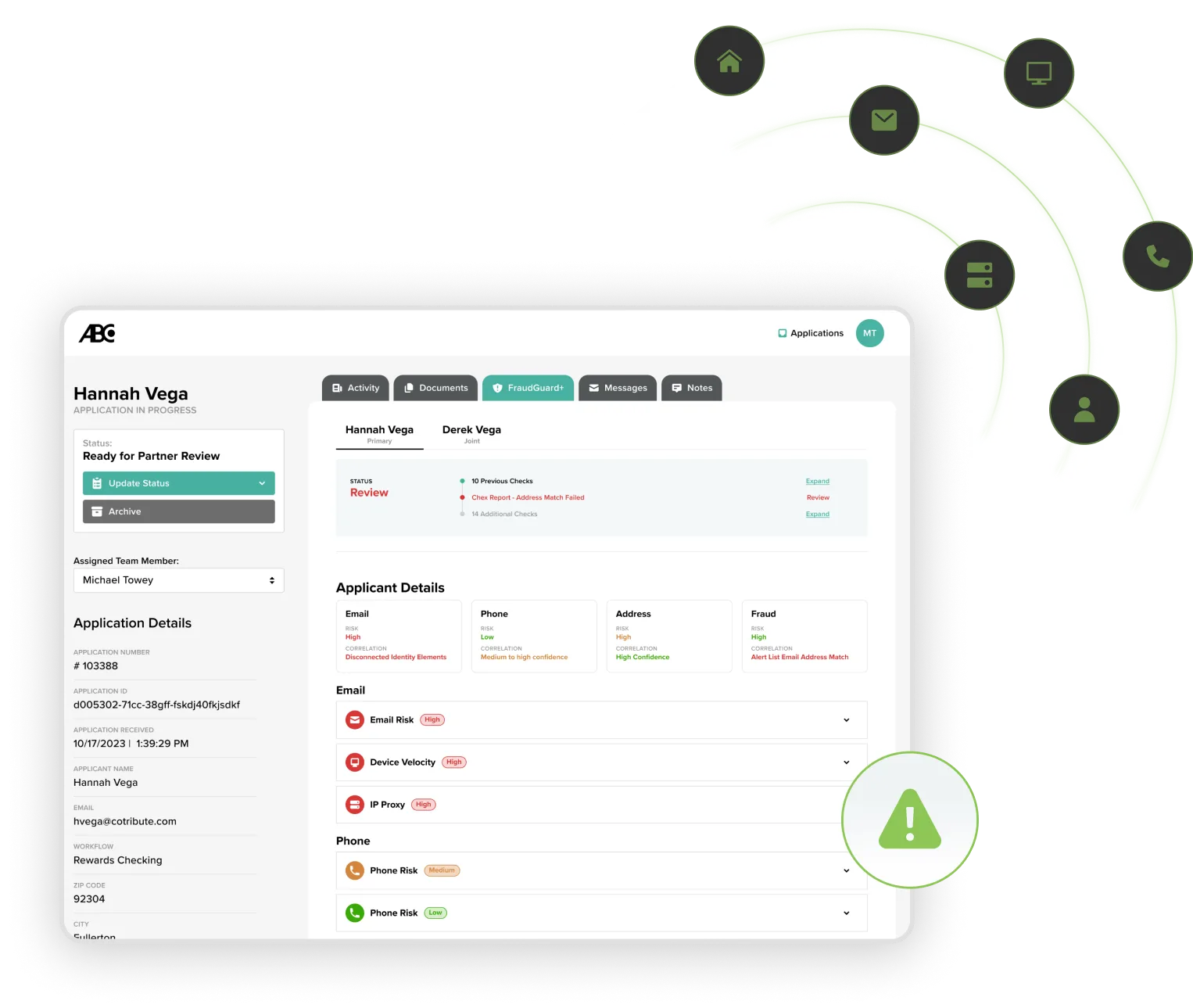

Detect Fraud Proactively

- Cutting-Edge Fraud Prevention

Leverage advanced fraud detection tools, real-time KYC and KYB checks, and liveness detection to minimize fraud risks while improving conversion rates.

- Boost Compliance and Accuracy

Integrated data sources and configurable fraud rules ensure all processes meet the highest compliance standards, reducing errors and building trust with your customers.

- Improve Customer Retention

Reduce application drop-off rates by 60% with secure, efficient, and customer-friendly onboarding flows.

Optimize with Advanced Analytics

- Gain Real-Time Insights

Track and analyze every step of the customer journey with real-time data. Our platform empowers you to identify bottlenecks, optimize workflows, and enhance user experiences, ensuring your onboarding process operates at peak performance.

- Predict and Adapt

Leverage predictive analytics to stay ahead of customer needs and market trends. With instant access to actionable insights, your institution can proactively adjust strategies to improve approval rates, reduce drop-offs, and meet compliance goals.

- Continuously Improve

Turn data into opportunities for growth. Our advanced analytics enable iterative refinements to your onboarding process, helping you drive measurable outcomes such as increased customer acquisition, reduced operational costs, and higher satisfaction rates.

Cotribute in the news

See what other credit unions, industry leaders and press are saying about Cotribute